The peak of this market rally is almost here, says JPMorgan. Time to ditch U.S. stocks, and buy these instead, says Wall Street giant.

[ad_1]

Roses are red, violets are blue, will CPI turn into the stock market’s Waterloo? We’ll know soon enough.

Investor memories of getting singed last September are still fairly fresh, so caution abounds. All this has some pining for days gone by:

@simon_ree

Playing a sizable role in new year gains has been tech, though last week wasn’t great. Filings from hedge fund and other big money manager’s 13-F filings showed Soros Fund Management buying beaten-down shares of Tesla

TSLA,

while manager Seth Klarman increased stakes in Amazon

AMZN,

Alphabet

GOOGL

and Meta

META.

Read: Should investors‘ love affair with Tesla fade, here’s where they’ll shop next

That is backward looking, but one wonders if they have kept that momentum up. Caution is the rule for our call of the day, from a team led by JPMorgan’s top strategist Marko Kolanovic, who say it’s time to stop buying U.S. stocks as investors overprice recent good news on inflation and remain “complacent of risks.”

“We believe that the equity rally is unlikely to get the fundamental confirmation for the next leg higher. Once positioning recovers, Q1 is in our view likely to mark the high point of the market. We think that one should be using the ytd gains to cut equity allocations, and to reduce portfolio beta,” said Kolanovic and the team.

They say international equities — China/EM, Japan and Europe — “offer better risk-reward than U.S. equities.” This latest warning adds emphasis to Kolanovic’s assessment last month that the rally’s days were numbered.

Now hold on you say? Wasn’t this the guy who was bullish all of last year, to no great end? In JPMorgan’s defense, they say an underweight position on government bonds and overweight on commodities compensated for 9-month equity overweight last year, helping them edge past the benchmark.

Still, Kolanovic might have a lot riding on this bet, as others on Wall Street chime in. Chris Montagu and the team at Citigroup, for example, told clients they see fading bullish momentum for stocks, apart from European banks.

What JPM sees hurting this rally is recent weaker economic data and the anticipated weak earnings and guidance from the latest reporting season. “Recent equity inflows are likely running out of steam, while pensions’ overfunded status could drive an increase in their reallocation from equities to bonds this year,” they said.

Markets are neither pricing in a recession, and trading as if the energy crisis, Ukraine war and sharp monetary tightening never happened, says Kolanovic. So they are shifting more defensively, moving slightly overweight on government bonds.

They are also tilting investments to benefit from China reopening tailwinds — overweights in commodities, mostly energy and EM equities. Note, Bank of America’s latest fund manager survey revealed that bullish China equity positions linked to that reopening are considered to be the most crowded trade out there right now. Tread carefully.

The markets

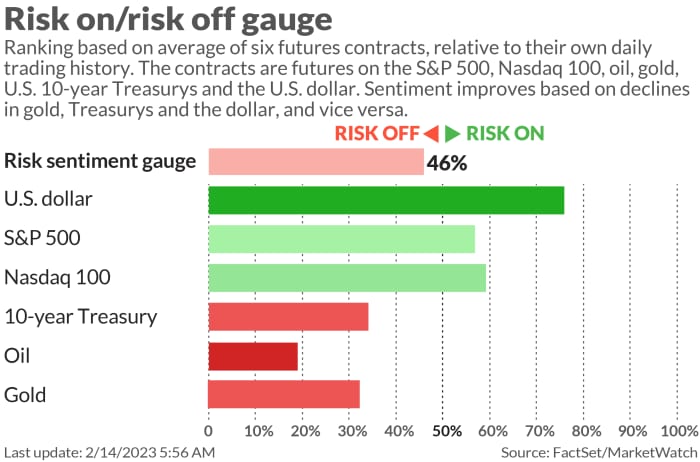

MarketWatch

Stock futures

ES00

NQ00

are understandably fence-sitting ahead of CPI data, as bond yields

BX:TMUBMUSD02Y

BX:TMUBMUSD10Y

ease, and the dollar

DXY

falls, along with oil prices

CL.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Economists expect CPI to rise 0.4%, and drop to 6.2% from 6.5% on a year-over-year basis, and at the core, to fall to 5.4% from 5.7%. Elsewhere, a survey showed small-business sentiment ticked up in January.

Ford

F

is cutting 3,800 European jobs amid a shift to electric-vehicle production.

Coca-Cola

KO

earnings are ahead, while Marriott MAR shares are up after the hotel chain’s forecast beating results and upbeat outlook. Akamai Technologies

AKAM

and Agilent

A

are reporting after the close.

Palantir Technologies stock

PLTR

is up 16% after the software company reported its first profitable quarter. Avis Budget shares

CAR

are up 5% after the rental car group posted higher revenue. IAC/InterActiveCorp. stock

IAC

is up after the brand holding company topped earnings expectations.

T2 Biosystems shares

TTOO

are down 7% after the diagnostics company announced a public offering of common stock and warrants. It also reported positive data from T2Biothreat Panel that quickly detects biothreat pathogens.

President Joe Biden is set to name Federal Reserve Vice Chair Lael Brainard as his economic-policy coordinator.

Best of the web

“Keep going until you’re killed.” Russian soldiers increasingly being treated as cannon fodder in Ukraine as war drags on.

Rescuers continue to find survivors of last week’s deadly earthquakes, some are working to save trapped pets.

Swimming for their lives. Cyclone battered New Zealand declares a state of emergency.

The chart

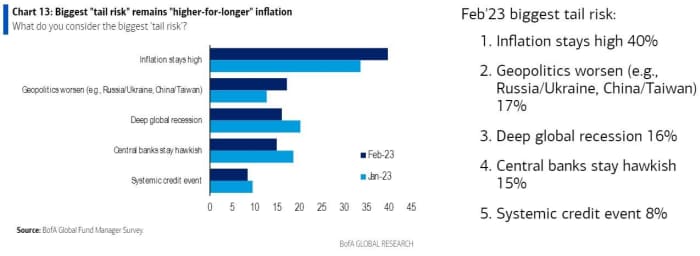

As JPM pointed out, the market is behaving as if a war is not happening. Of course, it is over there, and really in the bull’s-eye more for Europe than the U.S., which has China and balloons to worry about. But here’s a chart from that Bank of America survey of fund managers that offers some food for thought.

It shows that sticky, high inflation remains the biggest tail risk for investors, that is an event with a low probability of happening, but if it does, the damages could be outsize for markets. The second-biggest is geopolitics, and that’s as doubts grow of a peace accord between Ukraine and Russia in 2023 (expectations now down to 50% from 63% in January).

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

| TSLA | Tesla |

| BBBY | Bed Bath & Beyond |

| PLTR | Palantir |

| GME | GameStop |

| AMC | AMC Entertainment Holdings |

| AAPL | Apple |

| APE | AMC Entertainment Holdings preferred shares |

| NIO | NIO |

| MULN | Mullen Automotive |

| AMZN | Amazon.com |

Random reads

Historians crack 450-year old coded messages from a doomed queen.

The Hobbit house this man accidentally built.

Lovesick Americans spending $200 each this Valentine’s Day.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link